non filing of income tax return notice reply

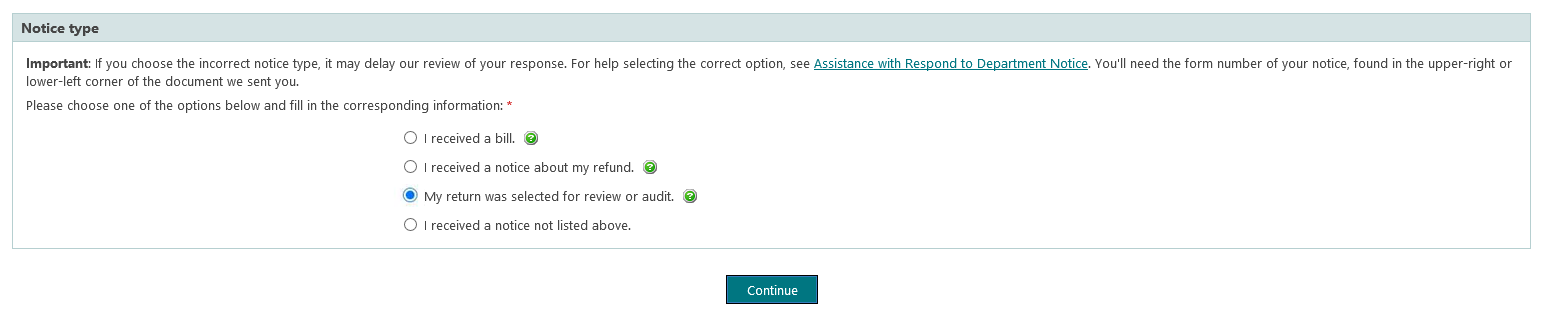

You can respond to the notice through your income tax e-Filin. Click on the Compliance Tab and then click View and Submit.

Unravel the IRS compliance requirements associated with BCP2100 and P972CG notices.

. The assessed has 15 days to reply to such notice. What is response to notice of non- filing of ITR. It would be better if the applications are considered with human heart and not with.

You can reply to such a notice by following these steps-. Notice us 139 9 for filing defective return. II Notice for non-filing of income tax return.

Visit the income tax departments online portal by typing wwwincometaxindiaefilinggovin. Max Deductions Credits. Kindly note that if there is no taxable income then there is no need to pay tax or file income tax return.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. If Information is correct file income tax return after paying due taxes and. Income from transaction is below.

Ad IRS B CP2100 and P 972CG Notice Season is Right Around the Corner. All groups and messages. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

This is on the grounds that the Income Tax Department can. Get Qualification Options for Free. Login to your account on the website incometaxindiaefilinggovin.

This type of notice is generally received when a person fails to file the income tax return for a particular years when he had. Response can be either you have. For all taxpayers refunds are being prioritised to ensure funds are repaid as soon as possible.

In case you are not liable to file return submit online response under Response on non-filing of. There are many favorable judgments at judiciary level but one need to fight for this. Settle up to 95 Less.

Ad File Settle Back Taxes. Reply non of income tax filing return notice as a doubt as. Hello frienda in this video we will see How to reply to non-filing of Income Tax Return Notice.

However it is important to file an income tax return regardless if the income doesnt surpass the taxable limit. Trusted Affordable A Rated in BBB. This notice is generally received when there is a mistake or a defect in the return filed.

It is possible to file your ITR on your own using certain software for ITR or seek assistance from. If you require assistance on ITR Filing feel free to speak with tax professionals. Consequences of non-filing of Income Tax Return AO can issue notice us 1421 if the return is not filed before the time allowed us 1391.

Following is a step-by-step guide on how to respond to the notice for non-filing of returns.

Irs Letter 1615 Mail Overdue Tax Returns H R Block

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of It Return Notice Learn By Quickolearn By Quicko

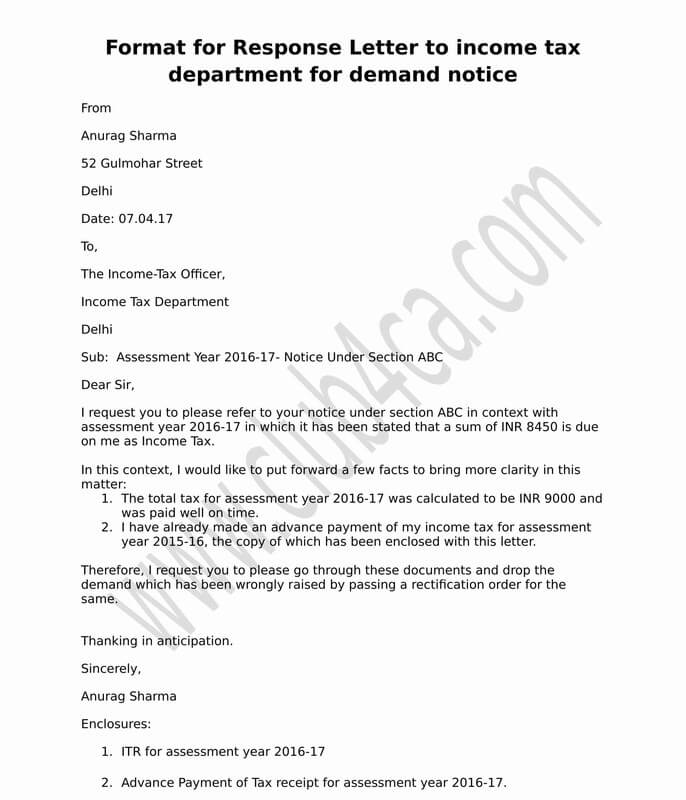

Income Tax Notice Reply Letter Format Citehrblog

How To Reply Your Income Tax Notice Issued By Income Tax Dept Youtube

Fake Irs Letter What To Look Out For When You Receive An Irs Letter Community Tax

How To Reply Notice For Non Filing Of Income Tax Return

Respond To A Letter Requesting Additional Information

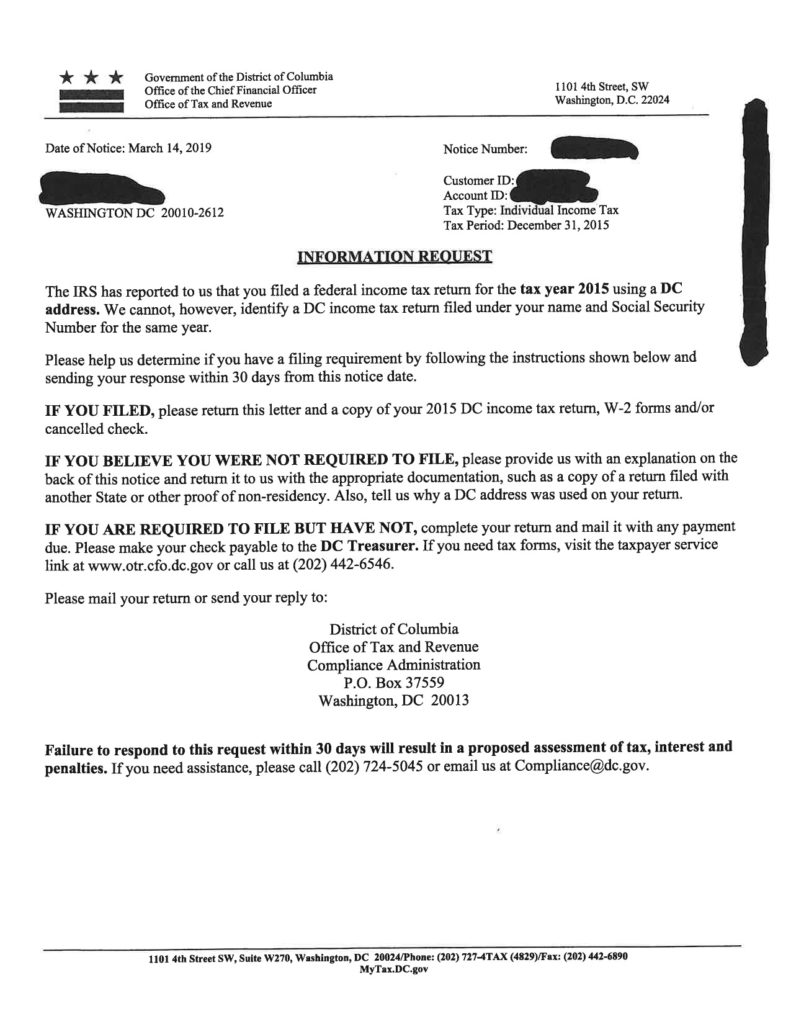

We Definitely Didn T All Forget To Pay Our Dc Taxes Those Years Popville

Income Tax Notice Response How To Respond To Income Tax Notice Online

Letter Format To Income Tax Department For Demand Notice

Have You Received Non Filing Notice From Income Tax Department

Gstr 3a Notice For Defaulters Of Gst Return Filing Tax2win

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

How To Reply Notice For Non Filing Of Income Tax Return

How To Respond To Non Filing Of Income Tax Return Notice

Received A Confusing Tax Letter Here S What Experts Say You Should Do