is there a tax on death

A few states also levy estate taxes as well so you could get. This means that there would be effectively two or even three death taxes.

The Coalition Says Labor Plans To Introduce A Death Tax If It Is Elected Is There Any Evidence Abc News

The new law is all the more punitive because it applies the 16 estate tax 6 on top of the earlier 10 gift tax to any gift within three years of death.

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

. However tax may be due on any interest earned by the death benefit. Some states also apply an inheritance tax in which the beneficiary could also be taxed after. Currently estates under 114 million are.

Only a handful of states still collect an inheritance tax. The Estate Tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF.

Federal estate taxes and in a few states state estate taxes apply before your property is transferred. While estate taxes seem to get all the publicity when it comes to taxes owed after someone dies the reality is that the majority of estates will not owe any federal estate taxes. Inheritance tax is different.

Death taxes are taxes imposed by the federal andor state government on someones estate upon their death. We have chronicled the multitude of poor tax policies implemented in Minnesota recently in Chapter 1 of the 6th edition of Rich. Youll have to pay taxes on any distributions taken out of the account at current income tax rates.

In just about all cases the death benefits paid by insurance policies are free from income tax. The death tax can be any tax thats imposed on the transfer of property after someones death whether that tax is based on the total value of the decedents estate or the value of a single bequest. The answer is that even though a person passes away his or her tax obligation remains.

There are two kinds of taxes owed by an estate. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. This includes both the Federal estate tax and state inheritance taxes.

Many family members wonder if it is necessary to file taxes for deceased persons. This includes government payments such as Social Security or Veterans Affairs death benefits. If the estate was reimbursed for any of the funeral costs you must deduct the reimbursement from your total expenses before claiming them on Form 706.

For the 2021 tax year the federal estate tax exemption was 1170 million and In the 2022 tax year its 1206 million. Those states with a tax have a relatively high threshold before taxes are due. This situation occurs when the payout of death benefits is delayed.

The state tax rate varies by state for example Nebraska charges 1 18 inheritance tax depending on the amount inherited and. Tax-wise the new IRA recipient is subject to the same tax rules that any IRA holder would be. First there are taxes on income or on capital gains earned during the last year of life.

You do not have to file taxes for a deceased parent unless you are the appointed executor of the estate. Although there is no death tax in Canada there are two main types of tax that are collected after someone dies. For instance if your TOD money market account has 12 million in it when.

Interest accrues on the funds during the delay and that interest is taxable when the funds are eventually paid out. The estate tax is as the IRS puts it a tax on your right to transfer property at your death All the cash and property you own at. In fact one of the first things to address is to avoid surprise debts by avoiding estate obligations in.

Going forward your beneficiary will be taxed on any interest earned on the account from the date she became the owner. Up to 1158 million can pass to heirs without any federal estate tax although exemption amounts on state estate taxes in certain states are considerably lower and can apply even when the federal. Fortunately these taxes are almost a thing of the past.

If you take those distributions before you reach the age of 595 youll likely have to pay a 10 early withdrawal penalty fee to the IRS. An inheritance tax is a state-imposed tax that you pay when receiving money or property from a deceased persons estate. The estate tax.

Such reimbursements are not eligible for a deduction. This tax is in addition to Minnesotas 16 estate tax. One on the transfer of assets from the decedent to their beneficiaries and heirs the estate tax and another on income generated by assets of the decedents estate the income tax.

Second there is interest or capital gains made on money in the estate. Fortunately there isnt a federal inheritance tax but some states charge it including. Typically filing a deceased persons taxes is a responsibility that falls to the executor the appointed administrator or the surviving spouse of.

The death tax is any tax levied on property and assets being transferred from the estate of a deceased person. If you have a lot of property you want to leave to your children or other heirs it may be subject to taxation. Dying may get you out of a lot of things but not taxes.

Accounting for reimbursed expenses. The federal estate tax sometimes called the death tax is a one-time tax that is imposed at death. This page contains basic information to help you understand when an estate is required to file an income tax return.

Individuals or beneficiaries who receive the income pay inheritance tax. Federal capital gains possible state capital gains and federal estate. Although beneficiaries are responsible for paying the inheritance tax while estates pay the estate tax many estates step in to take this financial burden off their.

The Coalition Says Labor Plans To Introduce A Death Tax If It Is Elected Is There Any Evidence Abc News

The Coalition Says Labor Plans To Introduce A Death Tax If It Is Elected Is There Any Evidence Abc News

Do I Really Need To Take Out Probate After My Husband S Death

Is Your Inheritance Considered Taxable Income H R Block

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

How Do State Estate And Inheritance Taxes Work Tax Policy Center

The Coalition Says Labor Plans To Introduce A Death Tax If It Is Elected Is There Any Evidence Abc News

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

The Coalition Says Labor Plans To Introduce A Death Tax If It Is Elected Is There Any Evidence Abc News

What Is An Estate Tax Napkin Finance

Death In The Family Turbotax Tax Tips Videos

The Coalition Says Labor Plans To Introduce A Death Tax If It Is Elected Is There Any Evidence Abc News

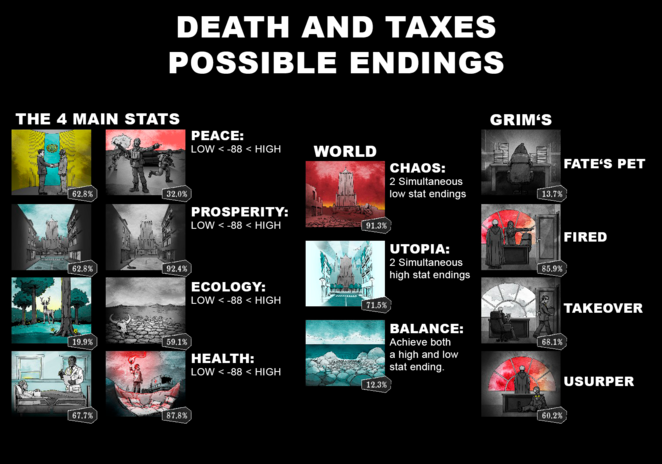

Death And Taxes Endings Guide Neoseeker

No Death No Taxes The New Yorker

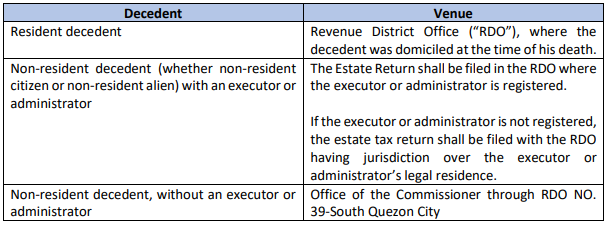

The Unspoken Cost Of Dying A Summary Of Philippine Taxes After Life Lexology

How Could We Reform The Estate Tax Tax Policy Center

/close-up-of-female-accountant-or-banker-making-calculations--savings--finances-and-economy-concept-1006671124-6a117470967b4b49960be0fb69f474a4.jpg)